Commercial Real Estate & Small Businesses

April 19, 2023

Commercial Real Estate – On Shaky Ground

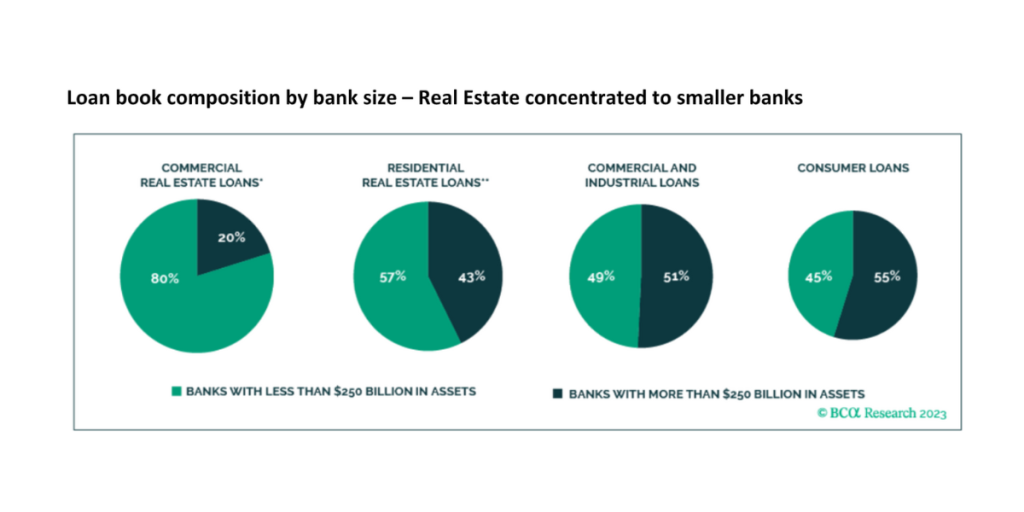

While equity markets recover and begin to climb the wall of worry, banking stresses have exposed sector specific vulnerabilities. The consequence of Covid lock downs have fundamentally changed working dynamics, a shift to work from home and displacement out of major cities. Three years and nine Fed rate hikes post Covid, 80% of commercial mortgages are now held by small to medium sized banks. While unassuming, a coming wall of maturities, tightening lending standards and climbing CMBS spreads are causes for concern in commercial real estate.

Recent troubles in medium sized regional banks, which collectively hold over $2.3 trillion in commercial real estate loans, are also facing near term troubles as over 10% of those loans mature within 2023. Bank runs and Biden administration proposals of increased regulation have already drastically tightened lending conditions. Additionally, the largely floating rate composition of commercial loans and wall of 2023 maturities are troublesome. Return to work occupancy rates are unlikely to push higher any time soon, as delayed Covid projects begin to also tip the market into excess supply. Mortgage payoffs and private lenders are unlikely to soak up much critical mass. Concurrently, private lenders are seeing waves of redemptions in their real estate investment funds, hitting semi-liquid fund gates for the first time in years.

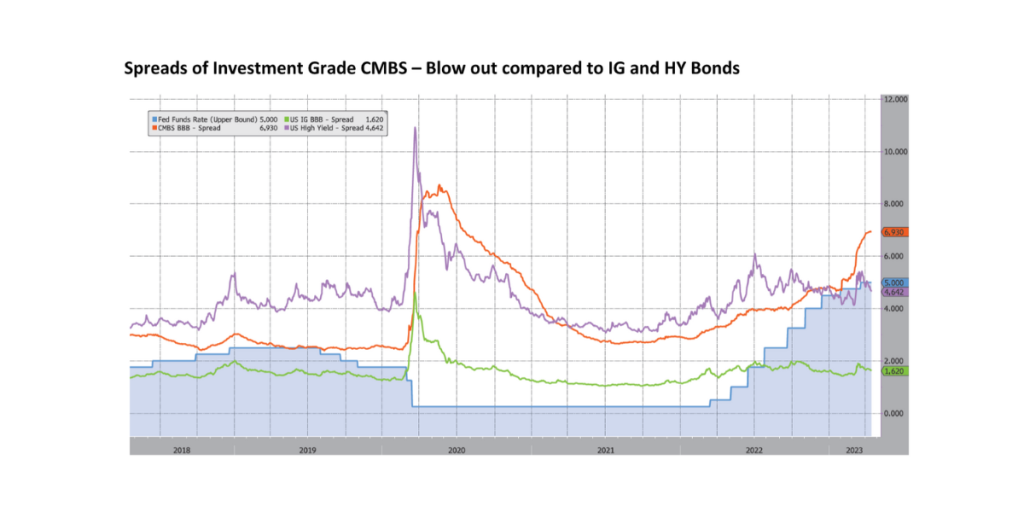

The contagion is unlikely to hit the residential markets as refinancing pre-Fed hikes and post GFC lending standards will limit any impact. Commercial mortgage-backed securities have seen bond spreads over treasuries blow out over the past month, trending opposite of high yield bonds (~2% higher). This is a catalyst in the knock-on impact to regional small-mid sized banks. Run on bank deposits for these institutions will exacerbate a sell off in CMBS securities, incurring even higher losses on their now held-to-maturity balance sheet holdings. Commercial real estate and small-medium sized banks should be underweighted for the near future.

Small Businesses, Moving Backwards

Miles Savitz, Junior Associate

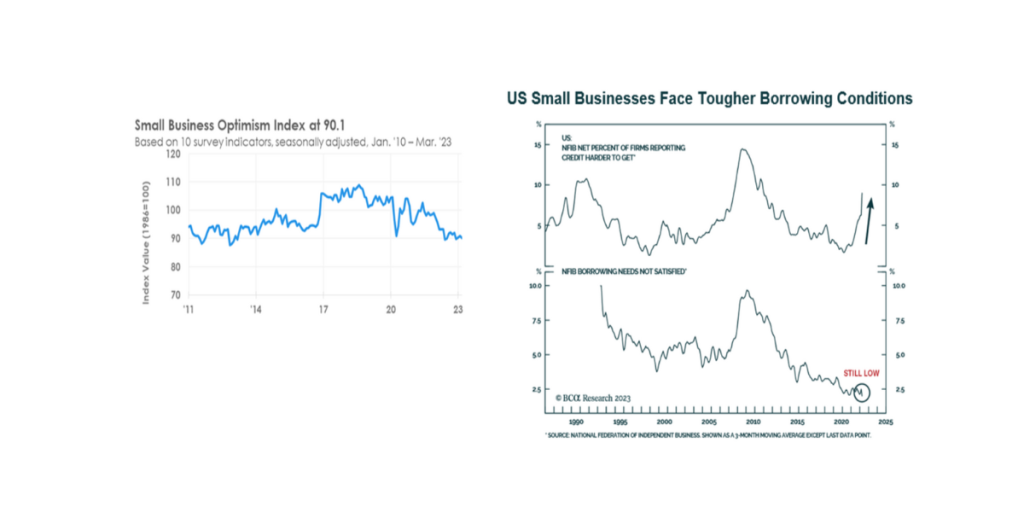

As interest rates remain high and the aftershocks of the banking crisis continue to be felt, small businesses have grown more pessimistic. In March, the NFIB survey showed that optimism among small business owners slightly decreased from 90.9 to 90.1. The index has been below its 49-year average since the start of 2022. A majority of those surveyed said that conditions would not improve over the next six months.

Small business owners are concerned about inflation, difficulty in hiring, and a decrease in sales. The difficulty in filling positions has remained historically high with 43% of small businesses reporting openings that were hard to fill. Additionally, fewer businesses are looking to create new jobs, only 15% in March compared to 17% in February. The number of businesses looking to increase wages in the short term has also decreased. A quarter of all respondents reported inflation as their biggest issue and expect real sales to be lower in the near term. The pressures small businesses are facing are only growing, and a sign of the recession on the horizon.

Along with all the difficulties that have existed for the past year and a half, it has become more difficult to access credit. More small business owners seeking loans described it as harder to get a loan in March compared to the start of the year. However, there is still only a small percentage of loan seekers, at 2%, that are unsatisfied with their borrowing. Nearly half of all banks were tightening lending standards even before the banking crisis and an even greater proportion will do so now after the crisis.

The market conditions for small business owners continue to worsen and are a sign of the difficulties businesses face over the next few months. Investors should avoid small cap stocks that are unprofitable because in the near term it will be difficult for these firms to find cheap liquidity through borrowing. Small cap companies that are unable to adapt to these new circumstances will suffer. Therefore, from an investment perspective, we are avoiding poor quality small cap equities as profitability and financing conditions for smaller businesses continue to worsen.

DISCLAIMERS & DEFINITIONS

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.