Debt Ceiling & AI Engine for Economic Growth

May 19, 2023

Why the debt ceiling doesn’t matter

The debt limit is the total amount of money that the U.S. government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.

The debt limit does not authorize new spending commitments. It simply allows the government to finance existing obligations that Congresses and presidents of both parties have made in the past.

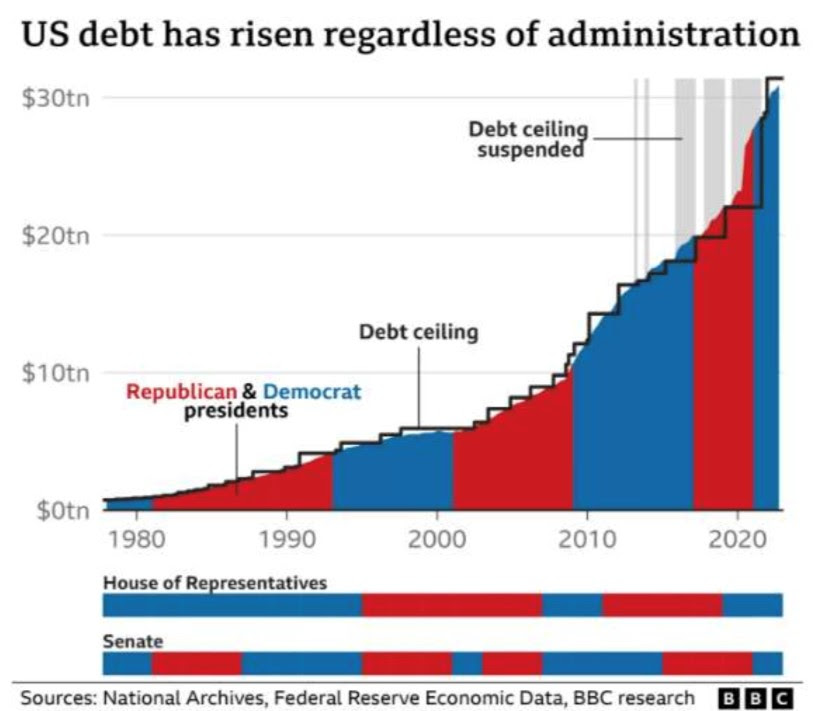

The mechanism was created during World War I to simplify borrowing. Prior to 1917, Congress needed to approve additional debt for each new spending measure it passed. Until recently, it has been a rather routine process. Congress has lifted the debt limit 78 times since 1960. The debt ceiling was last raised in December 2021 by $2.5 trillion, capping the limit at $31.381 trillion.

The debt ceiling does not have any economic meaning as it does not amount to additional budget spending. It is mostly U.S. political theatre, which is used by both the Republican and Democratic party from time to time to extract certain concessions from each other.

However, failing to increase the debt limit could have big economic consequences. As it could cause the government to default on its legal obligations – an unprecedented event in American history. Congress has always acted to raise the debt limit.

In the short term, there is no real pressure on President Biden to make a deal and he could take a hard line against the GOP and allow the negotiations to descend into a crisis. It is a crisis that could benefit him politically. Ultimately, if the U.S. is at the threshold of default, President Biden could do the most “Trumpian” thing available to him: keep issuing debt while daring the GOP to sue him.

Either way, we believe the U.S. is not going to default on its obligations for the purpose of domestic politics and eventually the debt ceiling will be raised without much economic impact.

AI brings a new engine for economic growth

“Citadel negotiating firm-wide ChatGPT license” “Google released ChatGPT rival AI ‘Bard’ to early stage” “ChatGPT reached 1million users within 5 days, compared with 570 days industry average”

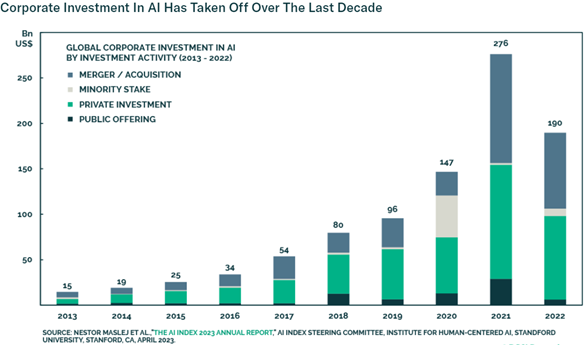

Artificial and Intelligence strategies have run ahead of broader benchmarks by ~10% YTD. Why and how does this matter? AI has the potential to automate jobs that are currently performed by humans. Rather than resulting in job displacement, it creates job opportunities and changes the nature of work. This reality is only starting to be appreciated by investors and economists worldwide.

Already, the UAE is experimenting with AI-monitored agricultural land in the desert, adjusting for temperature, insect and humidity levels. In addition to reducing manpower shortages in primary sectors, AI may also relieve import pressure from supply chain disruption. On the consumer side, ChatGPT acts as a research tool to answer queries with human-like responses. 7 months after release, it is already used as a conversational agent, virtual image generator, language processor, medical diagnostician, spreadsheet analyzer, etc. This is all due to a simple core function: digest massive amounts of data and offer evidence-based recommendations in timely manner.

Overall, productivity and efficiency increases are the core reasons why AI matters to businesses and economy. Long run economic growth is a function of productivity and employment. All historical advances in GDP have resulted from fundamental productivity and efficiency improvements: 100-fold GBP increase during Agricultural Revolution, 30-fold increase during industrial revolution, last 20 years’ of technology revolution.

Pricey AI applications and regulation will be headwinds, but the trend is inevitable and will create economic winners from those who can take advantage. As AI productivity contributions become evident, companies able to take advantage will be more likely to succeed and will be the leaders of tomorrow’s economy. Importantly, this won’t be limited to any particular industry as applications are transformational in every sector. Corporate margins will improve and this may well provide a tailwind to equity markets in coming years.

DISCLAIMERS & DEFINITIONS

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.