Hawkish Fed & Rare Earth Investing

May 26, 2023

Hawkish Fed vs tighter credit /liquidity conditions

A divergence remains between rates markets that expect the Fed to cut the Fed Funds Rate this year by 0.5% and the Fed’s more hawkish rhetoric. In our view, the Federal Reserve may be risking a policy error by overfocusing on lagging indicators (such as inflation and the labor market) instead of the lagged effects of the Fed tightening so far. Apart from weak US leading economic metrics and a recent softening in global economic surprise indicators, we see three risks to the Fed’s hawkish rhetoric.

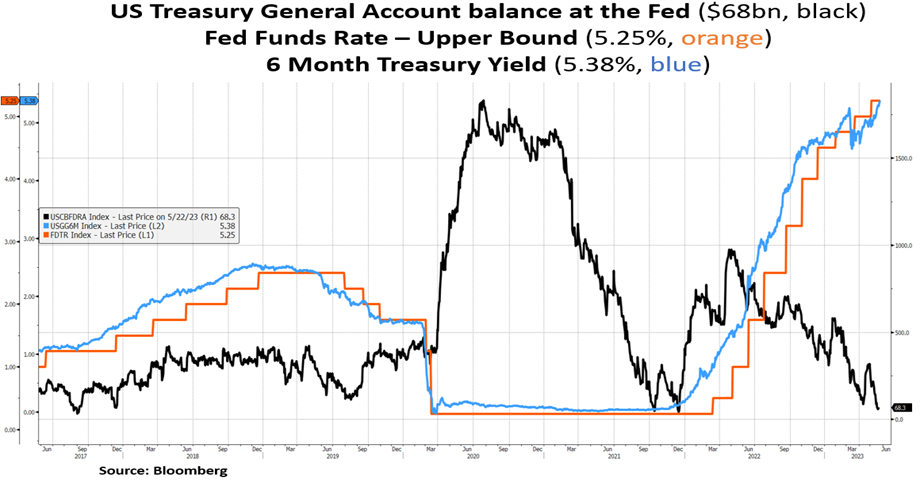

- A looming drain on liquidity conditions because of the upcoming TGA (US Treasury General Account) cash replenishing

- Tightening credit conditions because of tightening bank lending standards

- The negative impact on liquidity conditions due to the Fed’s ongoing quantitative tightening program ($95bn/month run-off rate).

As US politicians eventually reach a deal on the US debt ceiling with backloaded spending cuts there is an upcoming drain on liquidity conditions i.e. due to a surge in T-bill issuance to replenish the US Treasury General Account (TGA). Rebuilding of the TGA’s cash balance towards its medium-term level of around $600bn-$700bn by year-end will likely put upward pressure on short-end rates and the USD, as liquidity gets drained out of the private market and bank reserves. Bank reserve balances currently stand at $3.2 trillion and lower bank reserves will likely lead to marginally higher funding rates and further tightening of credit conditions. Headwinds to credit due to further stress in the banking sector could weigh on growth and inflation expectations. Recent surveys have been pointing to a material deceleration in credit demand and rising default rates from very subdued levels.

In conclusion, we view the triple headwind of TGA rebuild (> $600bn), Fed balance sheet contraction (~$600bn by year-end) and a weak credit backdrop as an unsustainable dynamic that will lead to the Fed’s capitulation moment. We suspect the Fed may be slow in cutting rates by year-end but at a minimum they will be forced to adjust or halt their quantitative tightening program, as credit tightening reduces the need for monetary tightening.

The case for Rare Earths

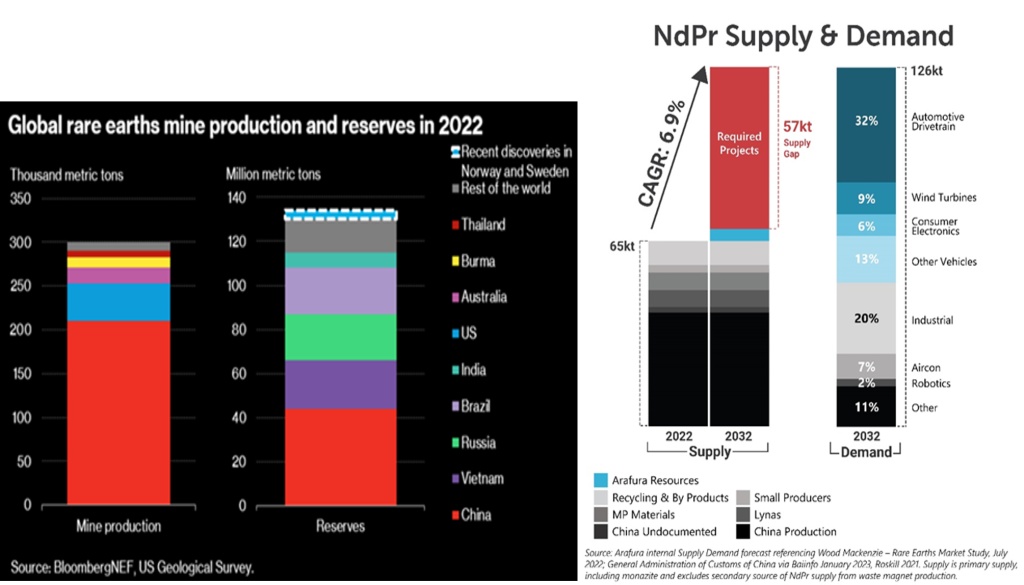

Rare earth metals comprise of 17 metallic elements, all of which play a vital role in numerous technological applications, ranging from consumer electronics, wind turbines and electric vehicles. As the world pivots increasingly towards AI, a digital economy and a green transition, the demand for these rare earths, including other critical minerals such as bauxite, cobalt, lithium and nickel, is expected to increase sevenfold by 2050, according to estimates by Bloomberg. Under a scenario consistent with reaching net-zero emissions by 2050, demand for rare earths could rise by 11 times.

China was responsible for around 60% of global rare earth mining, 85% of rare earth processing and 92% of rare earth magnet production in 2022. The EU and US import 98% and 80%, respectively, of their rare earths from China. With geopolitical tensions between China and the West elevated, coupled with the fragility of global supply chains that was magnified during the pandemic, there has been a concerted push in finding alternative measures. These have come in the forms of trade agreements, government-funded projects and joint ventures.

Despite an increase in demand, raising global production levels will not be easy. Many factors come into play – environmental concerns (ironically), tariffs, high capex outlay in the development-exploration of new mines and political red tape are just some of the obstacles. Most crucially, efforts to increase production will only bear fruit years later. For instance, the process to get permits can take 8 to 12 years. The near-term gap between outsized demand and constrained supply is likely to be a tailwind for rare earth prices.

Investing in physical rare earth metals can be complicated; a more straightforward way would be to invest via companies that produce them. Following stellar outperformances in 2020 and 2021, valuations of rare earth producers have fallen back to reasonable levels following the correction in 2022. In our view, the long-term outlook of rare earths is positive and warrants modest exposure as part of one’s overall asset allocation.

DISCLAIMERS & DEFINITIONS

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.

Investing internationally carries additional risks such as differences in financial reporting, currency exchange risk, as well as economic and political risk unique to the specific country. This may result in greater share price volatility. Shares, when sold, may be worth more or less than their original cost.

Asset Allocation does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.