Are REITS Turning a Corner?

April 8, 2024

REITs have been a cornerstone of yield-generating assets, especially attractive in the decade-plus zero interest rate environment. The long-duration assets were certainly impacted by the aftermath of COVID and central bank tightening but have reached record discounts versus private market transactions. After lagging in the global equities markets for the better part of two years, are REITs poised to rebound?

Valuations of public real estate tend to lag that of private markets – reaching decade-plus discounts in capitalization rate (net operating income divided by asset value), reaching over 2.5% spread at the height of 2022 drawdowns. Dispersion between REIT subsectors has been unusually high in recent years. The S&P U.S. or Global REIT indices, which comprise under 10% in office REIT exposure, have dominated headlines in a continued worry of a shift away from commercial and office space. Yet, work-from-home arrangements are concluding, valuations bottoming out and the sector is seeing signs of capitulation. The main concern remains the higher-than-usual debt maturity in commercial and office REITS in the near term, of which a significant amount is held by regional US banks.

The shift of developed economies with aging populations and the push towards AI and supercomputing demand have led to non-cyclical growth tailwinds. In-person retail and malls have reinvented themselves post-COVID. Tighter supply has led to more resilient, higher-end tenants, increasing per-square-foot rents. The e-commerce boom now requires sizeable warehouses and expanding distribution hubs, while AI and digitalization has led to higher demand in data storage centers and the expansion of 5G network communication networks. US single and multifamily remain in tight supply and higher mortgage rates make renting more attractive (mortgage to income vs. rent to income are above 2007 levels).

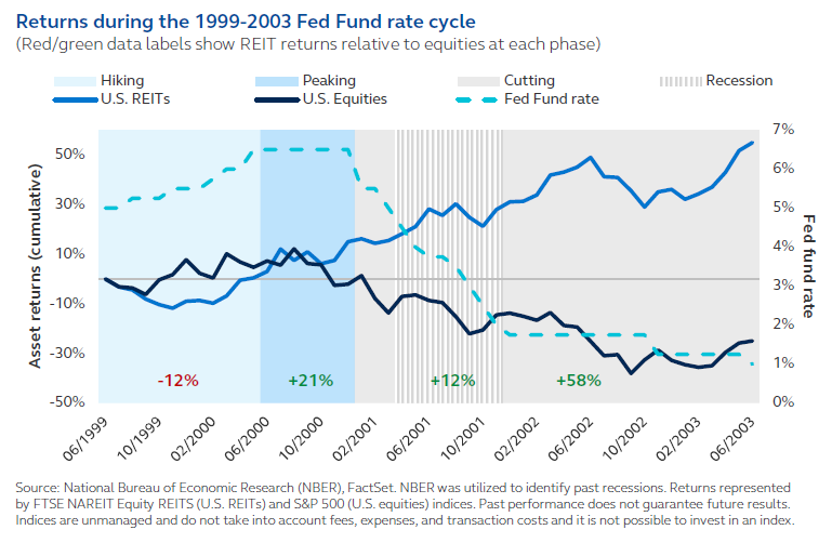

The potential for a slowdown in global growth and moderating inflation have increased the possibilities that developed markets hit peak rates and odds of global central banks cutting rates grow. While the risk of central banks pushing out action and mounting debt in commercial subsectors remains low, valuations are largely discounting these scenarios. The interest rate-sensitive sector would benefit from the prospects of lower rates and tend to outperform in falling inflationary environments.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the Prospectus.

S&P US REIT Index defines and measures the publicly traded property companies within the United States of America.

S&P Global REIT Index defines and measures the investable universe of publicly traded property companies.

The FTSE NAREIT All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. Equity REITs. Constituents of the Index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.