Is U.S. Consumer Credit at a Tipping Point?

February 19, 2024

U.S. consumer credit growth decelerated to 2.4% (year-on-year change, Y-Y) in December 2023 from a recent cycle peak of 9.9% Y-Y in April 2022. In the same period, U.S. personal consumption expenditure has declined from 5.3% Y-Y to 2.9% Y-Y. The U.S. personal savings rate remains low at 3.7% and pandemic excess savings have largely disappeared, especially for households at the bottom end of the income distribution who have the highest marginal propensity to consume. In our view, rising consumer credit delinquency rates will likely cause consumer credit growth to decelerate further as banks are forced to tighten lending standards.

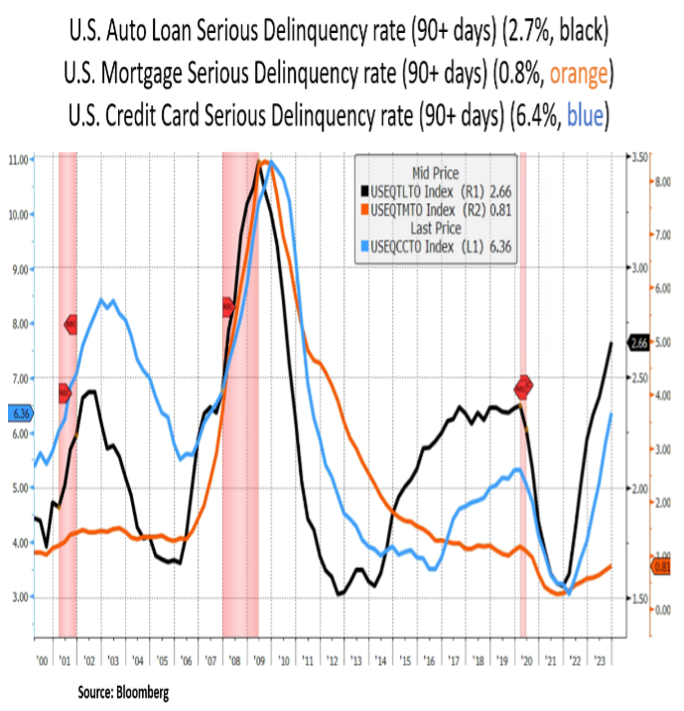

As shown below, the transitions of credit card and auto loans into serious delinquency (90+ days) are rising above pre-pandemic levels; especially for younger consumers (18-39 years old). We note that credit card delinquency rates of 7.5% at small banks exceed respective rates at large banks, which currently stand at 3%. Private-label credit card issuers are also seeing an increase in delinquency rates. On a more positive note, other types of debt such as student loans and mortgages have delinquency rates below pre-pandemic levels. Moreover, despite the rising household debt service ratio, it remains historically low (i.e. 9.8% Sep 2023 vs. 13.3% Dec 2007). To be sure, a low effective mortgage rate of 3.8% has been a pillar of financial support for most U.S. households during one of the fastest tightening cycles in the history of the Federal Reserve.

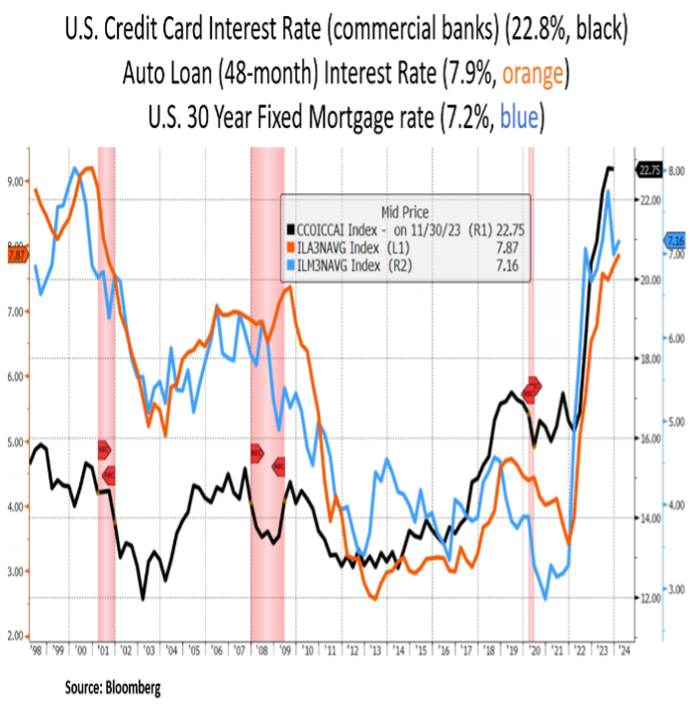

Nonetheless, in the face of still high borrowing costs (see chart below) and tight credit availability, it is plausible that this delinquency cycle has more room to run; particularly if demand for labor weakens in 2024 in response to weakening consumer credit growth and, consequently, weaker consumer spending. Lastly, with labor participation back to pre-pandemic levels and wage growth moderating, income growth is poised to slow over the remainder of 2024.

In conclusion, we expect lower- and middle-income household cohorts to increase their propensity to save in the face of lower credit availability and decelerating demand for labor. As U.S. personal consumption expenditure accounts for 68% of U.S. GDP, the pace of consumer credit growth will likely hold the key for U.S. economic growth in 2024. From an investment perspective, we remain constructive on long-duration assets that would benefit the most from an eventual Fed easing cycle.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.