Do U.S. Political Affiliations Influence Consumer Confidence Data?

April 16, 2024

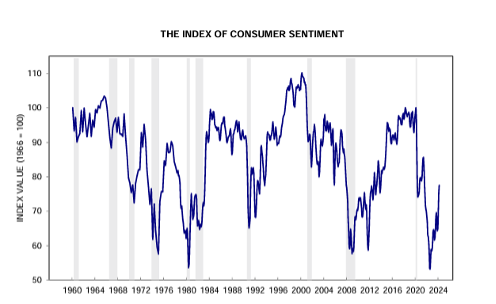

U.S. consumer sentiment appeared to be rebounding in late 2023, showing signs that the American public was less pessimistic about the state of the economy. However, since the turn of the year, there has been minimal positive momentum. The persistence of inflation and overall lingering negative sentiment about the economy means that consumer sentiment remains low. Inflation has been one of the main drivers of consumer pessimism throughout the post-war US. The two lowest points of recorded consumer sentiment by the University of Michigan were in 2022 and the early 1980s when inflation was as high as 14%. The Consumer Sentiment Index hit an all-time low in June of 2022, but quickly rebounded in 2023. The index has remained relatively unchanged since the turn of the year, due to recent negative inflation reports and the FED maintaining an elevated rate environment.

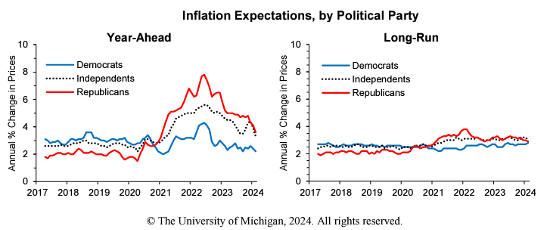

Sentiment may remain little changed throughout 2024 because of the strong correlation between approval of the President and consumer sentiment. A divide has always existed between how Republicans and Democrats view the economy based on which party controls the White House. However, the gap between the political more than doubled from Obama to Trump. The gap has decreased slightly under Biden, but the partisan divide is still significantly greater than what it was under Obama or Bush. A clear example of this is expectations about inflation. Long-run expectations for inflation remain relatively consistent between the two parties. However, during Trump’s presidency, Democrats believed inflation would be higher, but as soon as Biden was elected, Republicans were the ones with expectations for higher long-run inflation. The most striking difference between political parties is the year-ahead expectations for inflation. Republicans have had a considerable difference in expectations about inflation since Biden was elected. They have held expectations that inflation will remain at much higher levels for longer than Democrats expected.

Increased partisanship in the country has led economic data to become more closely tied to one’s party affiliation rather than reflecting the true state of the economy. Consumer sentiment may not change drastically again until after the election in November, which means economic conditions could be improving even if our data about sentiment does not change.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or

reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The U of M Consumer Sentiment Index is a survey of consumer confidence conducted by the University of Michigan and Thompson Reuters. The Michigan Consumer Sentiment Index (MCSI) uses telephone surveys to gather information on consumer expectations regarding the overall economy.