Is Cash Still King & A Maddening May for Munis

June 2, 2023

Is Cash Still King

With cash yields approaching 5% after a 15-20% down year for markets, it’s easy to throw in the towel. After all, 5% won’t make anyone rich but it’s much better than 2022’s results. Looking backward, it’s tempting to de-risk portfolios and collect 4-5% risk-free until it is clear that we are out of the woods. Unfortunately, it is unlikely to be the right trade on a 5-year horizon for most investors.

First, sticking with cash and getting out of the market requires not one, but two, correctly timed decisions. The first is when to exit, but assuming that is now done, the difficult task of timing re-entry becomes key. Warren Buffet famously said “Be fearful when others are greedy. Be greedy when others are fearful.” In other words, the biggest gains come when most are bearish, which is the case today. Waiting for positive consensus implies missing out on the gains that occur during the transition from bearish markets to bullish.

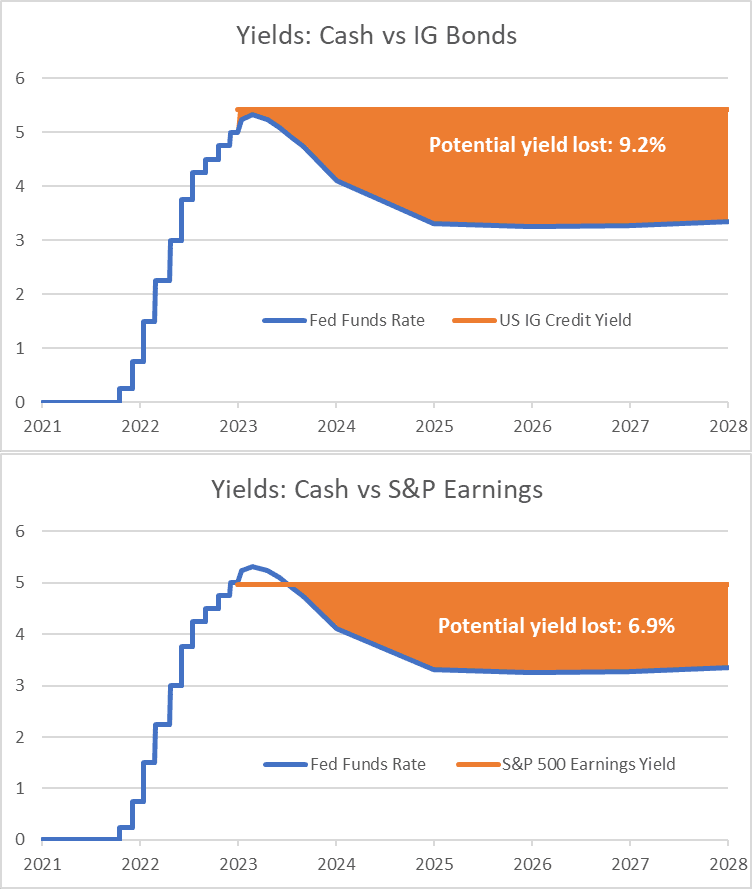

Second, while a 5% yield on cash may seem great relative to the last 10 years, it is unlikely to last that long. Bond markets are pricing low ~4% cash yields by mid-2024 and ~3% by 2025. So 5% for 6 more months followed by materially lower rates thereafter. The problem with cash is that the rate is not permanent and will trend down when growth concerns arise. In contrast, buying 5-year investment grade bonds locks in a 5.4% yield for 5 years. Doing the math on rate differentials, that’s an extra 9.2% over the next 5 years, or 1.75% per year, vs today’s cash rate expectations. Somewhat similar math can be done with stocks. S&P 500 earnings yield is 4.97% today – a bit lower than 5-year bonds, but still better than the average ~3% cash yield implied by markets for the next 5 years.

Lastly, this all assumes static market levels, which is of course unlikely. The reason for lower cash rate expectations is the likelihood of a recession in the next 1-2 years, which will likely lead to the Fed cutting rates. Bonds and stocks will benefit on top of their respective yields should rates fall as expected. 5-year investment grade bonds have a duration of 4 years, which means a drop in rates to ~3% will likely generate an 8% capital gain. Similarly, equities will likely rally as the rate used to discount future earnings will decrease.

Cash is without question a safer choice than bonds and stocks, but it is not without opportunity cost. Just as the Fed set its rate policy via a rear-view mirror understanding of inflation, investors are now in danger of setting their asset allocation the same way. In the next 2 years cash will transition from being the best performing asset class to the worst, much as it has been on average the last 100+ years. An allocation to longer-dated bonds, equities and alternative assets – alongside cash based on risk tolerance – will substantially improve investor outcomes over the next 5 years.

A Maddening May for Munis

Miles Savitz

Municipal bonds have struggled throughout May due to a variety of factors. There is still a fear of additional rate hikes by the Fed and there has been an increase in secondary market supply from FDIC‘s / BlackRock’s sales of the SVB portfolio. The debt ceiling crisis has also had a negative effect since Treasuries have been hurt by the crisis, and Munis and Treasuries are often correlated. May typically has been a strong month for municipal bonds as expectations tend to be high for summer rallies, but this month is on track to be the worst May since 1986 with a loss of 1.3%. There is a still a positive outlook for Munis as summer approaches, which typically leads to a decrease in supply and the debt ceiling crisis appears to be nearing a conclusion with a deal reached and voted on this week. Overall, Munis have performed well over 2023, with the S&P Municipal Bond High Yield Index increasing by 2.63% YTD. May was a difficult month but we expect higher returns in the short term as some of the current pressures abate.

With recent economic troubles, states with progressive income taxes, such as California and New York, have seen more shortfalls in tax collection. The inverse – states with flatter income tax rates – have seen fewer shortfalls in collection. Population levels are a good indication of future credit metrics. Texas and Florida cities have continued to see high inflows due partially to their lack of an income tax, whereas West Coast states and New York have seen outflows as the cost of living continues to rise. Local governments seem less affected by these dynamics because for the most part they do not levy income tax. The wages for public employees have not kept up with inflation, and over the next two years there should be a jump in the price of public employee labor. Higher wages will be needed to fill many of the vacancies that exist across local and state governments. In the short-term, the outlook for fiscal 2024 looks fine for state and local governments as they will be able to deal with the economic slowdown, but longer-term the increase in labor costs could lead to higher deficits and thus add pressure on the Muni sector.

The month of May was tough for Munis, but the short-term outlook is good as supply will likely decrease and current crises affecting Munis abate. Many state and local governments have improved their credit rating via robust tax collection over the last few years, which makes it likely that they will be able to withstand the approaching downturn in the economy.