Will European Tech Stocks Outperform U.S. Counterparts?

February 29, 2024

A growing tech bubble in advanced economies is increasingly a concern for many investors. On the plus side, there is an upside risk that the tech sector will rally further on the back of good earnings and easier policy from central banks later this year. In the negative column, however, are stretched valuations, increased competition, and memories of 1999. An interesting and overlooked way to play the rally going forward may be European tech names instead of their more famous U.S. cousins.

Unlike U.S. giant tech firms that pioneered cloud services, communication interaction, and AI advances, European tech companies specialize in semiconductor design, industrial automation, and technology applications within finance, e-commerce, travel, 3D design, and the like. The latter category of technology application offers more sector penetration and economic growth participation than U.S. names, which are less exposed to the global business cycle.

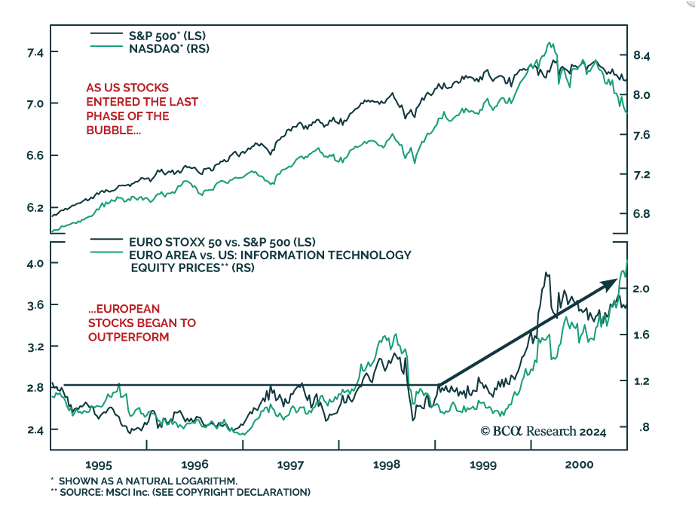

From a historical point of view, the lack of euphoria in European equities translated into outsize returns once before. In the later stages of the dot-com bubble, European tech, and even broad equities, outperformed their U.S. counterparts.

Subdued expectations result in easier-to-beat metrics. While the early benefits of AI accrued to U.S. companies, there is no reason to think that this limitation will persist. European companies, like all others globally, are building and implementing AI solutions already. Their relatively low valuations and earnings expectations present an opportunity for outperformance down the road.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The STOXX European Technology Fund seeks to track the performance of an index composed of companies from the European Technology sector.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 17 countries of the European region.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.