Bonds are Great Again

November 7, 2023

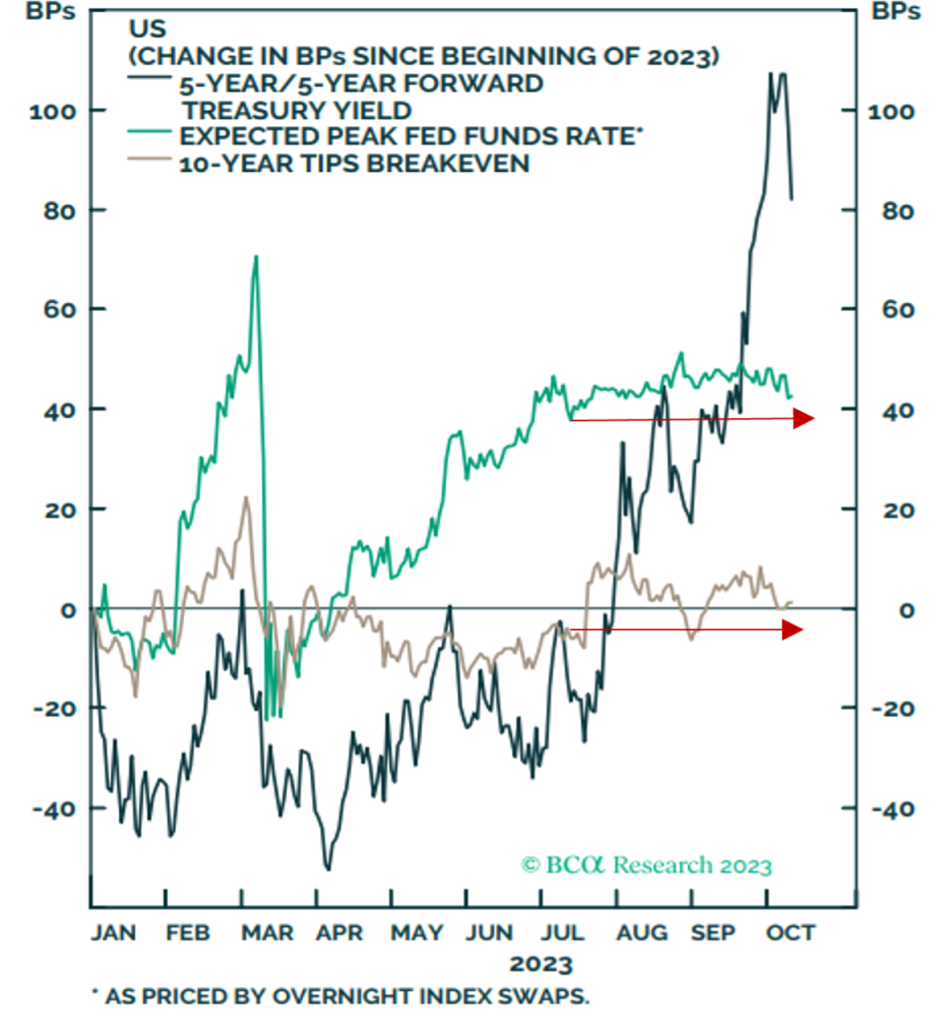

Recently climbing yields are not a sudden loss of confidence in U.S. treasuries. Instead, we believe that repricing of the neutral rate (higher for longer) is the main culprit behind the sell-off in September and October. Almost none of the recent long-term yield increases can be attributed to higher inflation expectations (see chart). Why then, do we think bonds are great again?

When yields come off historical highs, there will be an opportunity for capital gains. Treasuries will trade in a range for now – until end of the Fed tightening cycle. But when the recession arrives and the labor market runs out of steam, the Fed will be forced to cut rates to boost the economy. By then, equity markets may well be troublesome, but bonds will see capital gains from decreasing yields.

Bond risk-reward is more attractive than at any time in recent history. On the one hand, playing a defensive role in portfolios, bonds can mitigate the downside of portfolios through the upcoming recession. On the other hand, circa 5-6% annual returns from bonds will create demand from investors, compared with higher volatility stocks through downtrend markets. Goodbye TINA (there is no alternative) and hello TARA (there is a reasonable alternative).

Long-term investors should consider adding traditional fixed-income exposure, in our view.

DISCLOSURES

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks, including changes in credit quality, liquidity, prepayments, and other factors. REIT risks include changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and creditworthiness of the issuer.

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information.

Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results. This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.