Do Markets Care About Presidential Elections?

November 29, 2023

It’s that time again – 12 months to go to U.S. presidential elections. Odds are that we’ll see a 2020 rematch – Trump vs Biden – with a potential spoiler in Nikki Hayley. But it’s early days and predictions at this point notoriously miss the mark. Betting markets give a narrow advantage to Republicans while national and state-level polls have the Democrats squeezing by for a win. In the Senate, Democrats are defending more seats and are thus likely to lose their 1 seat advantage. For investors, however, the key question is this: does any of it really matter?

We know that economic fundamentals – income, employment, and consumption –have an impact on elections. But the reverse is less clear. Historically, fiscal policy is somewhat expansive ahead of elections and is tightened if the incumbent wins. First-term presidents typically preside over looser monetary policy as they have a strong mandate but by their second term, and frequently a more divided government, policy tends to turn restrictive. In this cycle, however, Trump tax cuts will play a big role. Trump will likely extend the cuts scheduled for 2026, if not increase them, whereas Biden would likely let at least some expire. Goldman Sachs estimates that a full expiration in 2026 would increase tax revenue by 1% of GDP, obviously slowing the economy and thus the stock market.

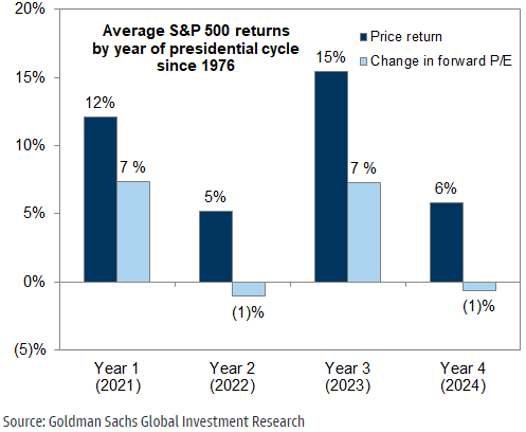

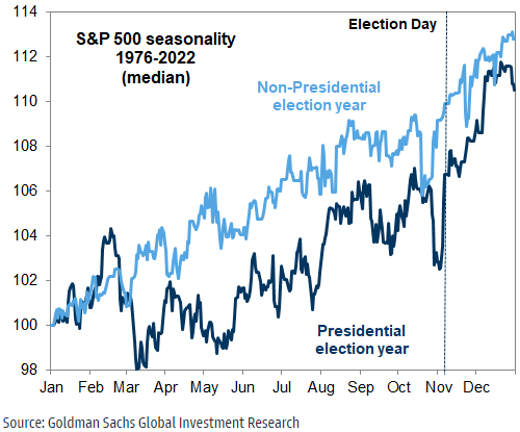

Empirical data from the last 12 election cycles gives us a simple punchline: since 1976, S&P 500 [RR1] returns have been strongest in the 1st and 3rd year of a presidential cycle and weakest in the 2nd and 4th. Versus a nearly 50-year calendar return average of ~9%, year 4 has been a relatively weak ~6%. Unsurprisingly, election year returns tend to be backloaded (after election day), when uncertainty is removed from markets, compared to a more even distribution in non-election years.

In short, historical evidence suggests that investors wanting to position themselves for the upcoming election process may want to lighten up on equities in favor of fixed income next year. Returns for equities will likely be positive in 2024 but are less likely to outpace bonds, which currently yield 5-6%. Risk-conscious investors may want to increase fixed-income allocations to generate similar returns with potentially less risk.

DISCLOSURES

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information.

Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results. This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.