Don’t Cheer the Employment Numbers Just Yet

October 22, 2023

Two weeks ago the U.S. Bureau of Labor Statistics published the September jobs report, showing +336,000 new jobs and making investors jittery about the direction of rates going forward. Past months were revised upward as well. Though Fed speakers spent the last 2 weeks telling markets that they may be on hold from this point onward, employment numbers like this should make all investors pause.

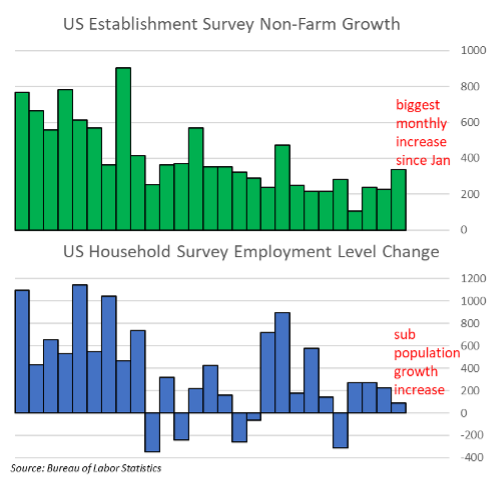

We do not believe the September employment report is a preview of things to come. Instead, it may well be the last hurrah. First, the +336,000 number is from the establishment survey, which counts the number of new jobs rather than the number of newly employed, which clocked in at +86,000 in the household survey. That number is below labor force population growth, which was +90,000. The difference can be attributed to multiple job holders and temporary hires. The former increased by +123,000, driven by full-time job holders taking on part-time roles for economic reasons. Hardly something to celebrate. The latter is driven by Amazon and other retailers hiring ~500,000 temps for the holiday season, which should reverse in a few months.

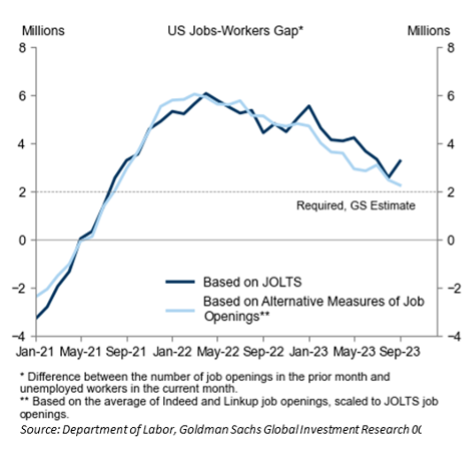

Second, compensation was unaffected with average hourly earnings growing only 0.2%, in line with August. We’ve now had 2 months of sub 3% annual growth rates in wages, which means incomes are rising less than inflation. No wage price spiral to be found here. Lastly, there are no signs of froth elsewhere within the labor statistics. The unemployment rate remained the same at 3.8%, as did average weekly hours worked (34.4). It is surprising to see a jump in new jobs not accompanied by more hourly work by existing employees. Importantly, the jobs-workers gap – the difference between number of job openings and unemployed workers – remains in a downtrend and is half of its January 2023 level. The job-workers gap is currently at ~2.5m, down from a peak of 6m, and alternative measures of job openings point to it approaching ~2m relatively soon.

The bottom line is that employment is a lagging indicator and is subject to seasonal adjustments and statistical updates. Current employment growth in Q3 is in line with GDP numbers, but forward-looking signs paint a picture of higher employment slack and lower bargaining power for employees in the future. Slowing growth is exactly what the Fed wants to see, which is why we believe they are done with this hiking cycle. As this becomes internalized by the market, we may see a Santa equity rally into year-end. Instead of persisting, the high rates caused by this last hurrah of employment will likely trend downward in coming months. Investors should use it as an opportunity to balance portfolios, adding ~5% yielding fixed income exposure that will serve as protection for continued deterioration in economic conditions in 2024.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.