Is it Time to Rotate to Mid-Caps?

December 6, 2023

Miles Savitz

MID-CAP: A mid-cap fund is a type of investment fund that focuses on companies with medium-sized market capitalizations. These are typically companies with a market value between $2 and $10 billion. Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks.

2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500. However, this past month has bucked that trend with a broad market rally. Much of the S&P 400’s YTD performance has come from the past month, where it is up 9%. Will 2024 be a year where mid-caps outperform both large and small caps?

If the economy continues to hold up in 2024, mid-caps are likely to outperform large-caps as the rally broadens and valuations come into play. Mid-cap companies are cheap compared to large caps, trading at 13x forward P/E, which is in the 6th percentile of the last 10 years. Compare this to large caps, which are trading at 18x forward P/E, in the 78th percentile. In addition, earnings expectations remain strong for mid-cap companies for 2024 compared to negative revisions recently for both small and large-cap companies.

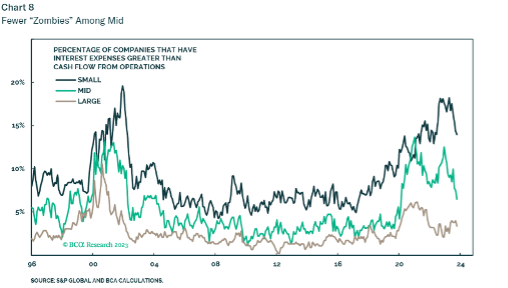

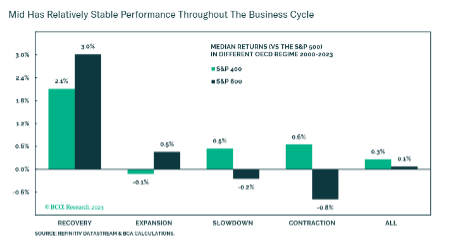

If, on the other hand, the economy begins to slow down or enter a recession, then mid-cap companies will outperform small-caps. As seen in the figure below, mid and small-caps (represented by the S&P 600) perform well in the early stages of the business cycle as soon as people sense a recovery. However, in the slowdown or contraction phase of the business cycle, mid-caps typically outperform small-caps. Downward market movements tend to harm small-cap companies far more than mid-cap names because the latter are usually in a better financial situation. They have lower debt to EBITDA and only about 6% of mid-cap companies have interest payments greater than cash flow from operations. That number stands at 12% for small caps today. An extended elevated rate and economic downturn environment will affect small caps far more than mid-caps.

Mid-cap names may end up being the ballast in portfolios during 2024. They are not as expensive as large caps, meaning they will experience greater growth if the economy holds up. And they do not carry the same debt and cashflow risks as small caps if the economy turns down.

DISCLOSURES

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The S&P MidCap 400 is an index published by Standard & Poor’s. The index comprises 400 companies selected as broadly representative of companies with midrange market capitalization (market valuation of between 200 million and 5 billion).

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The S&P 600 is an index of small-cap stocks managed by Standard and Poor’s. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements. This is determined by specific metrics such as public float, market capitalization, and financial viability, among a few other factors.

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.