Opportunities in Mortgage-Backed Securities

January 23, 2024

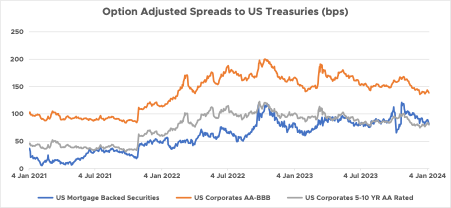

A fourth quarter drop in yields drove bonds to end 2023 with positive returns and further drove corporate credit spreads to one-year lows. With the recent move in yields, corporate bonds (both investment grade and high yield) are now looking rather fully valued as markets are pricing in a soft landing for the US economy. On the other hand, Agency Mortgage-Backed Securities (MBS) have seen option-adjusted spreads (OAS) move sideways on a year-over-year basis. Furthermore, MBS have a current attractive yield proposition, current low prepayment risk, and attractive duration characteristics.

Agency MBS, i.e., those securitized mortgages with either full or implicit US government backing (issued by Ginnie Mae, Fannie Mae and Freddie Mac), come with a US government credit rating of AA. The spread on these securities versus US government bonds, which currently sits at +0.8%, compensates for prepayment risk (the fact that most mortgage holders prepay/refinance over time, with an average life shorter than maturity). The great (re)financing cycle that occurred as the Fed embarked to increase rates in 2022, has now led to approximately 75% of outstanding mortgages at rates of less than 4.0%. This provides an interesting backdrop with mortgage rates now hovering at or above 7%. Even a 2-3% fall in mortgage rates would only put 10-15% of outstanding US mortgages in a place to potentially refinance.

MBS securities have historically exhibited negative convexity – when rates increase their duration increases and duration falls when rates are cut. What had been a negative attribute when the Federal Reserve began hiking rates in 2022 (higher duration leads to a larger negative price impact), has now turned to slightly positive convexity for the first time in 25 years. What may seem trivial, is now an opportunity as markets currently price 6 rate cuts through 2024 and could lead to a fuller MBS price participation rally.

With the run-up in corporate bond prices, we find MBS to be attractively valued and a high (credit) rated pick-up in yield versus corporates. In fact, compared to similar maturity AA-rated US Corporate bonds, MBS is providing the same OAS (to US government bonds). In the case of an unexpected hard landing scenario, the Fed’s quantitative tightening program, currently letting up to $35bn of MBS runoff monthly, will likely end and provide a backstop in liquidity for MBS. For the above reasons, we find MBS as an attractive opportunity within fixed income allocations, both on a risk-adjusted and spread basis.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks, including changes in credit quality, liquidity, prepayments, and other factors. REIT risks include changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and creditworthiness of the issuer.