Peaking U.S. Shale Oil Production Supports Higher Long-Term Oil Prices

November 2, 2023

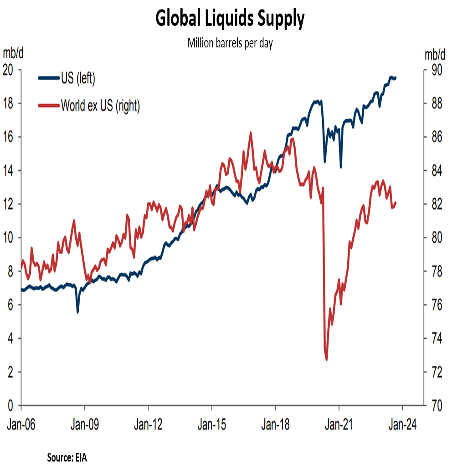

Shale oil production has revolutionized the U.S. energy industry, and it has been the only material source of non-OPEC+ supply growth over the past decade. U.S. shale currently accounts for 75% of total U.S. oil production i.e. 9.9 million out of 13.2 million barrels produced per day. Total U.S. oil production is up 61% since 2015 and the U.S. remains the key short-term marginal oil producer, where flexible short-cycle private producers sit high on the global cost curve. With crude prices having recently flirted with $95/barrel and geopolitical tail risk rising, the onus is again falling on the shale industry to step in to cover for any supply shortfall.

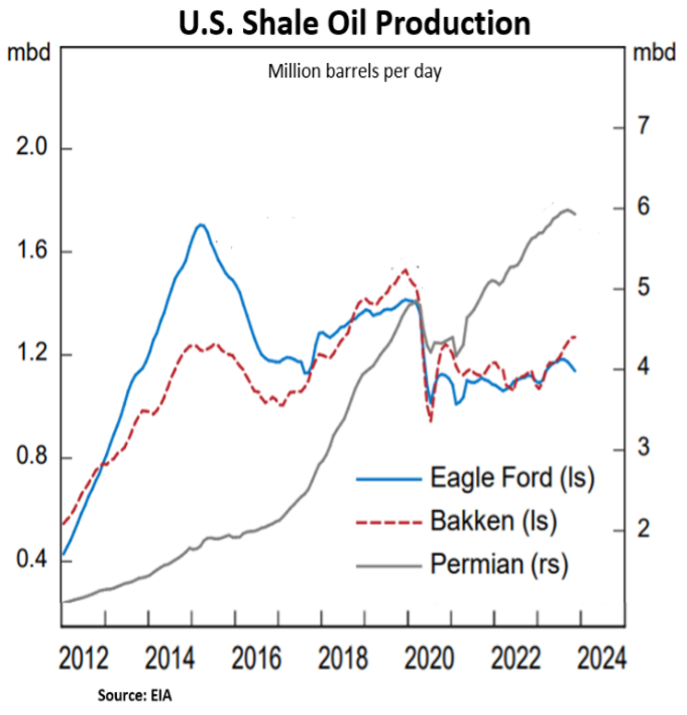

The key challenge for U.S. shale is whether the industry has the capacity and willingness to sustain rapid production growth. Shale wells experience extraordinarily sharp decline rates, with an output drop-off of roughly 75% just in the first year. As the most prolific wells deplete, operators either move on from their “tier 1” acreage to where reservoirs are shallower or develop more “infill” wells where extraction is more difficult. Both options require ever more drilling and efficiency enhancements to maintain – let alone grow – current levels of production. Moreover, as we can see in the below chart, there are clear signs that apart from the Permian, most shale fields are at or nearing maturity. The Eagle Ford topped out in 2015, while the Bakken followed suit in 2019. The Permian basin has driven all growth in U.S. crude supply since early 2020 and its YoY growth has slowed substantially in recent months (0.5mb/d year-over-year from 0.9mb/d in 2019). Apart from productivity limitations, management teams are focusing more on maximizing profitability and return on capital rather than production. With conservative drilling and capital spending plans management teams appear more focused on capital discipline, industry consolidation, and capital returns as demanded by shareholders.

In conclusion, at a time of low global spare capacity and global supply shortfalls, the U.S. shale oil industry’s role as the marginal supplier is facing challenges. The consequence is an environment of high oil prices which is more influenced by OPEC+’s current trajectory of production cuts and OPEC+’s ability to balance the market as an offset to rising geopolitical risk premium in the Middle East.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information.

Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results. This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.