Rising Yields: A Buying Opportunity

October 23, 2023

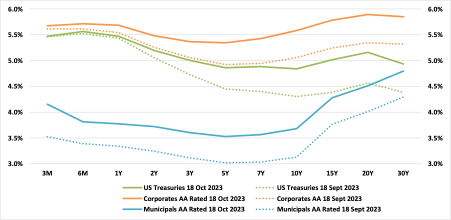

The past few weeks have seen a pickup in bond volatility, as measured by the MOVE index, back to levels seen in early 2023. Congresses’ passing of a 45-day funding bill in early October and the Fed’s hawkish positioning have led to a rise in Treasury yields and credit spread widening. Medium to longer term rates have moved substantially over the past month, with the 10- and 30-year rates moving +0.50% and +0.55% respectively. While the Fed has called for a higher for longer interest rate regime, the past month’s rise in yields and the recent dovish turn in Fed rhetoric provides an opportunity in fixed income markets.

The US budget approval to avert a government shutdown, along with the Fed’s continued reduction of its balance sheet has resonated in Treasury markets as US Treasury issuance has risen +26% year over year. We expect periods of yield retracement, which will largely be a return to dovish Fed comments on mixed economic data and a flight to safety as conflict escalates in the Middle East. US Treasuries remain at attractive values as the absolute level of yields offers a buffer against additional rate hikes, while also offering scope for capital appreciation as the Treasury market will eventually discount rate cuts by the US Fed.

Municipal bonds (Muni’s), which have been shunned over the past two years, have seen a pickup in investor inflows as increased issuance has pushed absolute yields higher. The Muni yield curve has seen spreads begin to narrow over Treasuries, offering attractive yields at medium to longer term maturities. At the marginal highest US tax brackets, Investment Grade Munis offer a +1.0% – 2.5% yield pickup over Treasuries and Corporate bonds across the curve. In addition, closed-end Muni funds are trading at a 10%-15% discount to value, three standard deviations below 25-year averages, which have been disadvantaged by investor outflows and leverage. While state and local government collections are down year over year, they have stabilized since Q1 2023.

Returns in bonds have no longer become lopsided – the high nominal yields provide a buffer in the event the Fed does raise rates. Spreads have widened modestly in both Investment Grade and High Yield and are likely to start to increase into year-end, offering less attractive values vs. their superior returns year to date. While the Fed has called for a higher for longer interest rate regime, we believe that higher real yields, anomalies in employment data, and falling inflation, place a near-term cap on yields and an opportunity to increase fixed income duration.

DISCLOSURES

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Merrill Lynch Option Volatility Estimate (MOVE) Index reflects the level of volatility in U.S. Treasury futures. The index is considered a proxy for term premiums of U.S. Treasury bonds (i.e., the yield spread between long-term and short-term bonds).

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.