US SPR – a quick recap of the oil stopgap

July 26, 2023

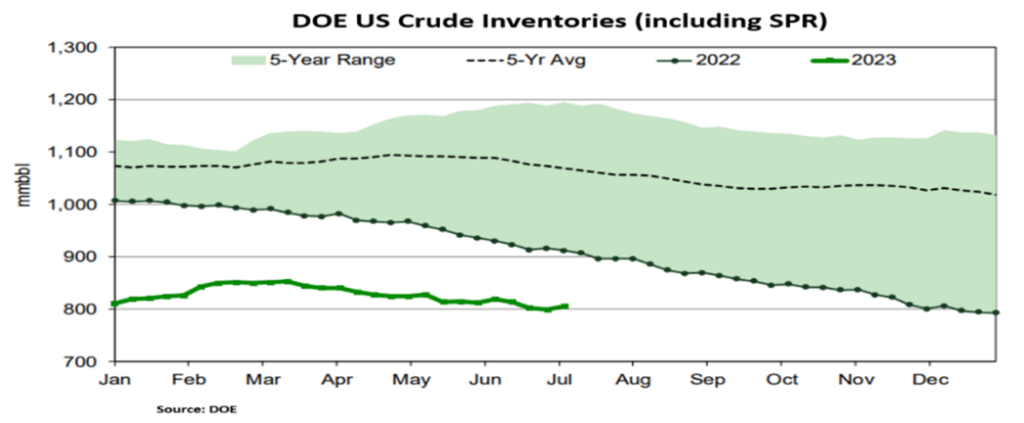

The SPR was established in the 1970s after the Arab oil embargo resulted in a global energy supply shock and a gasoline shortage in the US, leading to long delays at the pump. Decades later, the SPR still serves a vital function, providing a safety net against geopolitical turbulence and potential supply disruptions. After 180m barrels were sold in 2022, the SPR now sits at 347 million barrels. This is – a level unseen since 1983, and a mere half of total authorized storage capacity of 714m. This implies that the emergency reserves are equal to just 20 days’ worth of US supply, a record low. Due to certain congressional acts regarding SPR oil sales and other technical & fiscal constraints, the oil market expects 40-60m barrels as the limit of the SPR refill.

The Department of Energy (DOE) highlighted that it could pursue opportunistic repurchases when advantageous for taxpayers and it has started repurchasing crude oil for its SPR. They’ve awarded contracts 3m barrels (bbls) in August, 3.2m (bbls) of buybacks in Sept and the potential for further repurchases Q4 2023. However, this has been a netting effect, after the DOE released 7.2m bbls from the SPR in June and total sales in Q2 ‘23 of 25.7m bbls. Replenishing the supply will be a nontrivial and lengthy process according to experts, who say that a lack of funding and old infrastructure will hinder the process. Funding has fluctuated, as Congress decided to strip $12.5 billion earmarked for reserve oil purchases. This further complicates the situation, as the DOE is left with $4.3 billion to acquire oil (enough to buy 57m bbls). This is far short of an amount to fully restore the SPR. Therefore, the pace of refilling the SPR will be sluggish and likely take years to replenish reserves.

There are also technical constraints regarding the refill speed. Per the DOE, the rate of extraction capacity from the SPR is around 6x the rate of fill: 4.2m bpd (barrels per day) vs 685k bpd. The SPR was designed to get the oil out quickly but not necessarily to get it in quickly. Even at the maximum fill rate, the impact for support for WTI oil prices would be significantly less than the weight put on oil prices by the supply increases during 2022. Therefore, we do not expect a material impact on WTI oil prices from the SPR refill as injection rates are much lower than withdrawal rates, in a background of tight US supply/demand.

DISCLAIMERS & DEFINITIONS

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information. Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.