What’s Driving Energy Markets?

August 23, 2023

2023 has proven to be a volatile year for energy markets. By the mid-year mark the price for U.S. crude had fallen almost 12% YTD, nearly 45% below its 2022 peak. Recently, spurred by record high demand and better-than-expected economic growth, crude prices have rallied over 20% from their June lows. However, over the past week we have again seen prices slide back down, ending a 7-week rally for oil. Despite the notoriously dynamic and volatile nature of energy prices, recent volatility has caught many investors off guard and wondering: what is driving these markets?

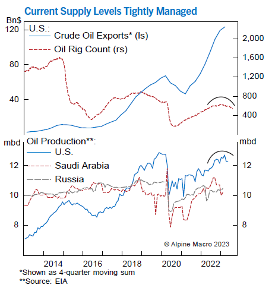

Energy started the year off slow, in fact by the end of June energy was the worst-performing S&P sector YTD. Many people attribute oil’s poor 1H23 performance to recession fears and a weakened Chinese economy resulting in low demand. However, that narrative is not fully supported by the data. Global oil demand reached an all-time high of 103mb/d in June, driven by an uptick in demand for mobility fuels (gasoline, diesel, jet fuel) as well as surging oil consumption in China, reported by the IEA. While rising consumption has lifted the price of oil, the same is true for falling supply. Global oil supply fell by 910kb/d to 100.9mb/d in July, driven by significant production cuts from Saudi Arabia and other OPEC+ countries, marking the lowest production levels since October 2021.

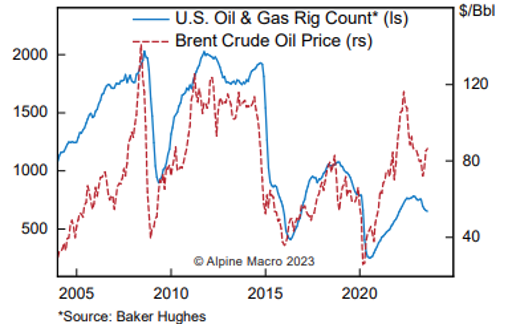

While oil staged an impressive 20% rally from its June low, recent disappointing economic data out of China has begun to shake up energy markets again. With the effects from summer travel and the reopening of China’s economy running out of steam along with slowing economic conditions, the IEA forecasts global oil demand growth to slow to 1mb/d in 2024. Additionally, while production levels from OPEC+ and Russia have been historically low, U.S. oil production is projected to hit an all-time high in 2023. It is also possible that with oil prices in the high-80s Saudi Arabia and Russia will reverse on their production cuts, especially in a weaking growth environment.

In the short term, we expect energy prices to remain volatile given the possibility of economic disappointment in China. Lower growth expectations from China, and possibly the U.S. will quell energy demand going forward. From a long-term perspective we remain positive on energy. We believe demand for oil will remain high in the medium-term as the transition to green energy will take decades, not years. Additionally, material underinvestment in the sector will lead to long-term supply constraints that will bolster energy prices.

DISCLAIMER

Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.