Is the Yen Poised for a Turnaround?

November 3, 2023

The Japanese yen’s weak showing this year got even worse in October. Year-to-date, its 13% decline against the USD makes it the weakest performer among G10 currencies. However, despite this underperformance, several compelling factors lead us to adopt a positive outlook for the yen.

Firstly, the Bank of Japan (BOJ) has refrained from raising rates due to deflation, in contrast with other central banks. This makes it difficult for the BOJ to cut rates in the event of a recession. Based on the chart below, this positions the yen favourably as there is a close correlation between USD/JPY and the yield differential between US and Japanese 10-year government bonds. With the Fed near the end of its rate-hiking cycle, yield differential is expected to narrow, thus leading to a stronger yen against the USD.

Secondly, the BOJ’s yield curve control (YCC) framework, which imposes a ceiling on yields, could be abolished. Prices of goods and services have rebounded significantly over the past 2 years. Wage growth is also poised to rise, following annual negotiations by Japan’s largest labor union calling for a minimum 5% wage increase next year. With the risk of deflation receding and inflation returning after decades, YCC may be discontinued sooner rather than later.

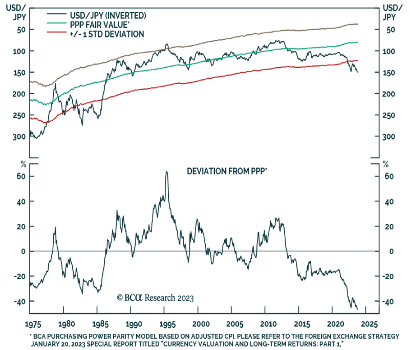

The yen is currently ~46% undervalued, more than one standard deviation cheaper, compared to its Purchasing Power Parity (PPP) fair value. The PPP exchange rate measures the price of a representative basket of goods and services across countries. In addition, pervasive bearish sentiment and heavy net short positions leave the yen susceptible to short-covering rallies.

Lastly, Japan’s net international investment position – the difference between foreign assets and liabilities – stands at ~76% of GDP, the highest in the world. Historically, in times of risk aversion, Japanese investors have repatriated foreign-based assets, selling them and converting the proceeds back to yen.

In conclusion, despite the yen’s challenging year to date, it appears to be gearing up for a reversal of fortunes over the next 6-12 months. The confluence of positive catalysts outlined above makes a compelling case for investors to consider exposure to the Japanese yen. Allocating to yen-denominated assets could prove advantageous for foreign-based investors, as any capital appreciation or income gains will be further enhanced if the yen strengthens.

DISCLOSURES

The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of Leo Wealth. Neither Leo Wealth nor the author makes any warranty or representation as to this information’s accuracy, completeness, or reliability. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall Leo Wealth be liable to you or anyone else for damage stemming from the use or misuse of this information.

Neither Leo Wealth nor the author offers legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Past performance is no guarantee of future results. This material represents an assessment of the market and economic environment at a specific point in time. It is not intended to be a forecast of future events or a guarantee of future results.